All it takes is a few clicks.

NJ Workers’ Compensation Law

The State of New Jersey passed its workers’ compensation law in 1911, making coverage mandatory for all employers.1 Workers’ compensation insurance gives benefits to your employees for work-related injuries or illnesses. This coverage is also known as workers’ comp or workman’s comp.

The State of New Jersey passed its workers’ compensation law in 1911, making coverage mandatory for all employers.1 Workers’ compensation insurance gives benefits to your employees for work-related injuries or illnesses. This coverage is also known as workers’ comp or workman’s comp.

Get a workers’ compensation insurance quote today and learn how we can help get your employees back to work faster.

Get a workers’ compensation insurance quote today and learn how we can help get your employees back to work faster.

New Jersey Workers’ Compensation Coverage

If your employee gets a work-related injury or illness, workman’s comp in NJ can help cover:2

- Medical treatment to help injured workers recover. New Jersey law gives employers or insurance companies the right to choose the healthcare provider for treatment.

- Lost wages if they can’t return to work for a time while they recover.

- Ongoing medical care costs, such as physical therapy or surgeries.

- Temporary total disability benefits if your employee can’t work for more than seven days.

- Permanent partial disability benefits, which depend on the type and severity of your employee’s injury. Sometimes, when an employee returns to work, they can’t do the same type or amount of work as before they got hurt.

- Permanent total disability benefits if your employee lost two major parts of their body or can’t work at all.

- Death benefits, like funeral costs, if your employee died as a result of a work-related incident.

When Is an Injury Covered by NJ Workers’ Compensation?

Workers’ compensation in New Jersey can help cover:

- Accidents or injuries caused from your employee’s work.

- Illnesses from working in an environment with harmful substances or allergens.

- Repetitive strain injuries, or repetitive stress injuries, that develop over time.

Who Needs Workers’ Compensation Insurance in NJ?

New Jersey has workers’ compensation requirements mandating every employer to carry this insurance. Even if your business is a limited liability company (LLC) or only hires part-time or seasonal employees, you need workers’ comp insurance in New Jersey.3 If you can’t provide proof of coverage, you may have to pay a fine or face criminal charges.

New Jersey has workers’ compensation requirements mandating every employer to carry this insurance. Even if your business is a limited liability company (LLC) or only hires part-time or seasonal employees, you need workers’ comp insurance in New Jersey.3 If you can’t provide proof of coverage, you may have to pay a fine or face criminal charges.

Be aware there are some workers’ comp exemptions to New Jersey’s law, such as:

- Unpaid interns

- Unpaid volunteers

- Independent contractors

- Sole proprietors with no employees

NJ Workers’ Compensation Rates

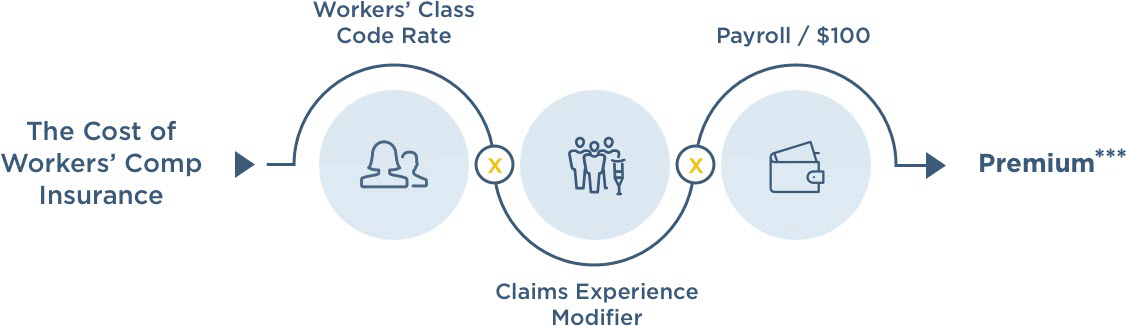

You may be asking yourself, “How is workers’ comp calculated?” Insurance companies look at different factors when coming up with workers’ compensation rates. You can use this simplified formula to help you understand what makes up workers’ comp costs:

Class Code Rate X Class Experience Modifier X (Payroll/$100) = Workers’ Compensation Insurance Premium**

Classification codes, or workers' compensation class codes, describes the type of work your employees do. They differ depending on the amount of risk.

Payroll gets multiplied by a specific rate that matches the class code. Each class code has a rate per $100.

Experience modification number refers to your claims history over the last five years. Having a clean claims history can lead to a lower insurance cost. Be aware experience modification numbers are subject to state requirements and don’t apply to every policy.

What Is the Minimum Payroll for Workers’ Compensation in NJ?

There is a minimum and maximum payroll for executive officers. The minimum average is $660 per week, or $34,320 a year.4 The maximum average weekly payroll is $2,640 a week, or $137,280 a year.5 The minimum and maximum payroll helps control premiums and claim benefit amounts.

Common Questions About Workman’s Comp NJ

What Happens If I Don’t Have Workers’ Compensation in New Jersey?

If you don’t have a workers’ comp policy in NJ, you can face:6

If you don’t have a workers’ comp policy in NJ, you can face:6

- Fines up to $5,000 for each 10-day period that you don’t have coverage.

- Criminal charges, since failing to get insurance is a disorderly person’s offense. You can get a fourth-degree charge from the State of New Jersey.

Workers’ compensation penalties don’t often come from refusing to get coverage. Instead, they can come from misunderstanding employee classifications. As a business owner, you’ll need to know how to classify contractors, temporary employees or consultants. You can use the ABC test to help you determine if a person is an employee or independent contractor.

How Does Workers’ Compensation Work in NJ?

If an employer gets notified about an accident, they should report it to their workers’ comp insurer and file a First Report of Injury with the New Jersey Division of Workers’ Compensation.7

If the claim gets accepted, the insurance carrier directs the injured worker to an authorized medical provider. If the employee can’t work for more than seven days, they can also receive temporary disability benefits.

When Does Workers’ Compensation in New Jersey Start?

There’s a seven-day waiting period before workers’ comp benefits begin.8 If your injured worker can’t return to work within that period, they can start getting temporary disability benefits. There isn’t a waiting period for medical benefits or permanent disability benefits.9

What Happens in a New Jersey Benefits Dispute?

Through New Jersey’s workers’ comp settlement process, employers, employees or insurance companies can file a formal “Claims Petition” or an “Application for an Informal Hearing” with the state’s Division of Workers’ Compensation if there’s a benefits dispute.

During an informal hearing, you or your employee can hire a workers’ compensation attorney for legal representation. A judge makes a ruling during the hearing, which isn’t binding on either party.10

A judge’s ruling is binding if you or your employee files a formal claim. Appeals in these situations go to the Appellate Division of the Supreme Court.11

Learn more about how a workers’ compensation settlement works.

Where Can Employers Get New Jersey Workers’ Compensation?

It’s a good idea to work with an experienced insurance carrier because they can answer your questions or help you through the claims process.

Businesses across the US have trusted us with their workers’ comp coverages for over 100 years. We understand every business has unique needs and our specialists will be with you every step of the way. From getting a workers’ comp quote to filing a claim, we’ve got your back.

4,5 NJ Workers’ Compensation and Employers Liability Insurance Manual, “Manual Amendment Bulletin #495”